Moving into 2019 we at Synfuels Americas thought it prudent to bring some of the current energy market conditions into a projective scope. As has been the case for decades now, energy markets are in constant flux. Not necessarily rampant, volatile instability; just more fluid. However, as most government officials and business leaders know, it only takes one development or policy misstep to throw things into disarray. As it stands, we are not fortune tellers, but as experienced energy market and policy experts, we can take an educated guess at what the tea leaves of 2019 may be telling us.

The seminal question for 2019 will be, “How much more market share can natural gas take from coal?” The U.S. EIA expects coal’s share of electricity production to decline a nominal percentage as natural gas makes up for the deficit. This does not portend an ongoing death of coal. As we’ve noted in past blogs, developing nations have a hard time converting to a lower-carbon standard due to the higher price of conversion from current infrastructure and lack of generating capacity for booming Asian populations. Mostly coal will see a small decline in the nations that have already scheduled coal-fired power plant retirements. In other parts of the world they will be coming online at lower generating levels with yet quite a bit of scalable generating capacity in reserve. This is of course courtesy of the toothless Paris Climate Accords where a group of prominent nations made more or less a gentleman’s agreement.

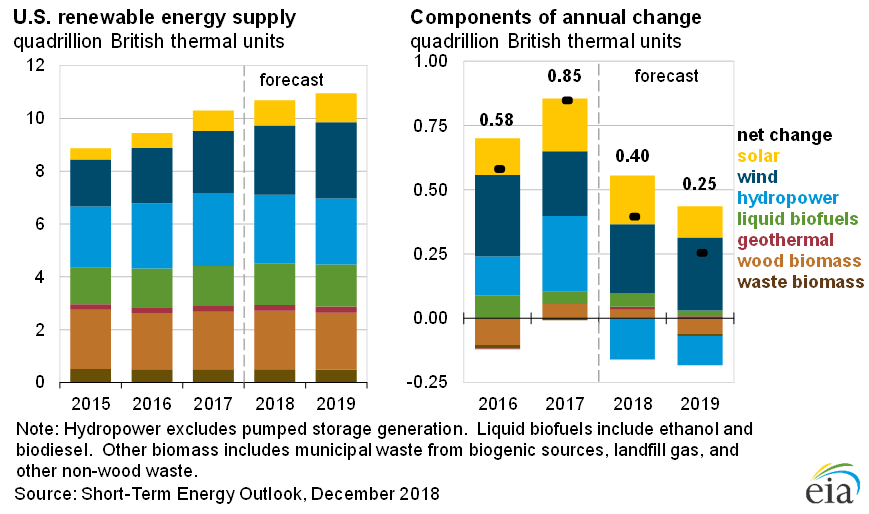

Unlike years past, secular renewable energy (Wind Turbine and Solar Photovoltaic generation) will be facing major obstacles to their development and proliferation. Especially, in the United States where production and construction tax credits are set to expire- such a worry that Tesla’s Elon Musk implored prospective buyers to purchase new EVs prior to expiration so they may collect the credit while Tesla’s products remained competitive.

The United States is likely to see a continued relative boom in solar and wind generation construction in 2019. Not because the industry is so attractive, but because any construction that takes begins in 2019 is eligible for tax credits over the coming years. So, many companies will begin construction now to maintain the financial viability of their projects as 2020’s projects will not be held in the same esteem as before.

Continued lower prices in for crude oil and natural gas will prove to be a major hindrance to renewable energy development. In politically motivated places like California, some development will likely continue. However, global demand is set to remain focused on traditional energy generators as economic growth is projected- even expected –to slow. Should global economic growth contract, then all bets are off and the global renewable market may take a few years to recover, considering it has no other downstream utility other than electricity generation. Fossils on the other hand possess adaptability, and the world’s petrochemical industries are expected to continue to grow- despite a potential drop in demand for transportation fuels.

As for crude oil development, now nobody can be sure what the crude oil market in 2019 will look like. In EIA’s most recent outlook it forecasted a 2019 average price for Brent crude at $61/bbl and WTI holding an average $7/bbl below that. What many should find interesting is the EIA range for WTI prices in 2019- $36/bbl to $77/bbl. On the other hand, there are plenty of bullish investors and market researchers that still see an opportunity for oil to still reach $90/bbl. Taking government agency assessments into account, it is unlikely $90/bbl will be seen in 2019 unless the Middle East erupts in widespread turmoil. The more likely outcome will be continued lower prices as the U.S. is expected to flirt with 12mm b/d in 2019 and the other major producers maintain or increase output as well.

One cause for production and price concern will be Iran, and how the sanctions applied to that nation will affect prices. In 2018, other countries were given waivers to purchase Iranian oil. As geopolitical strategies play out, there could be potential scenarios where more Iranian oil can reach the market. Especially, since President Trump has overt animus for higher prices.

In the background of energy market growth and development will be public environmental policy. Could some governments see an opportunity to push forward aggressive climate policy if oil and gas prices were to tumble again? Many current policy recommendations advocate taxing crude, gasoline and diesel to fund green energy projects while phasing out fossil fuels. Recently, President Macron in France felt the furious uproar of the voters he angered by subscribing to that very application of policy. That time it did not go as planned. However, should prices decline lower in 2019 there could be an opportunity to apply that type of policy in a friendlier political and economic environment.

The most likely policy implementations globally will be the shoring up of transmission capacity. Lately, many nations have become aware of grid vulnerability, and with the coming rollout of 5G communications networks, the security of power and communications have never been a higher priority. It’s the delivery and control of power resources that enable customers to enjoy lower prices. With consistent, secure, and optimized control people can have power on demand. In the utility realm, there is nothing more important. The need for the security of the resource for generation is tied to the demand of a customer wanting light when they flip the switch. So, in terms of 2019 energy policy, grid security is the most likely tangible application of government priority.

As usual there are many variables affecting energy prices and in turn market growth and development. The year ahead is likely to bring some surprises just like every other year. The key to maintaining growth, however, is the consistent understanding of macro-economic factors and mitigating risk. That appears to be something that the world’s energy producers have become very adept at. That trend likely will continue in 2019.