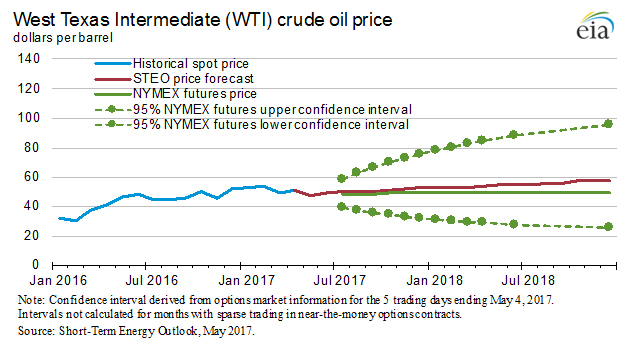

May could be shaping up to be the beginning of another round of industry consolidation due to a precipitous fall in crude prices, or a move to higher prices from production cuts by OPEC and depletion beginning to show itself in the United States’ shale plays. Currently, WTI crude is priced at $47.59/bbl. This is a 3.8% gain from the recent three-month low of $45.83 on Monday May 8th. The Energy Information Administration released its short-term outlook for May on the 9th, and their 2017 price forecasts appear to maintain the status-quo with WTI expected to average $51/bbl. The 2018 forecast shows positive pricing developments into 2018 with an expected spot price to average $55/bbl (7.8% increase over the 2017 average).

Last month, June crude spot prices and futures contracts moved into contango. Contango is an event in which the futures contracts for a commodity are selling at a discount in comparison to the actual spot price of the good. This is a phenomenon that portends a lower demand for crude, and potentially the end of low-price production should some exploration and production firms keep rolling their futures contracts into losses. Whether firms do roll themselves into losses or not seems to be of little consequence if demand is seen to be low. This could possibly all be countered, though, if OPEC agrees to extend its production cuts beyond mid-2017 to last the rest of the year. Moving forward, a continued supply cut could relieve the inventory glut currently seen in downstream fuel stocks:

If we are currently seeing an increase in crude and refined product stocks, the major short-term concern now could be aggregate demand. With the EIA forecasting an increase in U.S. crude production to 10 million b/d from the 2017 average of 9.3 million b/d, and stable price increases in concert, it is likely the global oil industry is beginning to experience a bullish pricing cycle. This is, however, subject to geopolitical machinations that could cause pricing spikes, supply shortages, and lowered economic expectations.

In summation, the O&G market is likely reaching a precipice of some variety. With the macroeconomic activity currently experienced, and a relative level of geopolitical unrest near very sensitive and important trade routes, we should begin to see some things shake out in the short-term.